View the Scholarships Webpage HERE for up to date information and reach out to our Scholarship Coordinator at Scholarships@lsua.edu.

Scholarships are another free source of financial aid that is awarded based on a variety of criteria such as academic performance, leadership, community involvement, etc. Scholarships may be awarded by the university or through an outside agency.

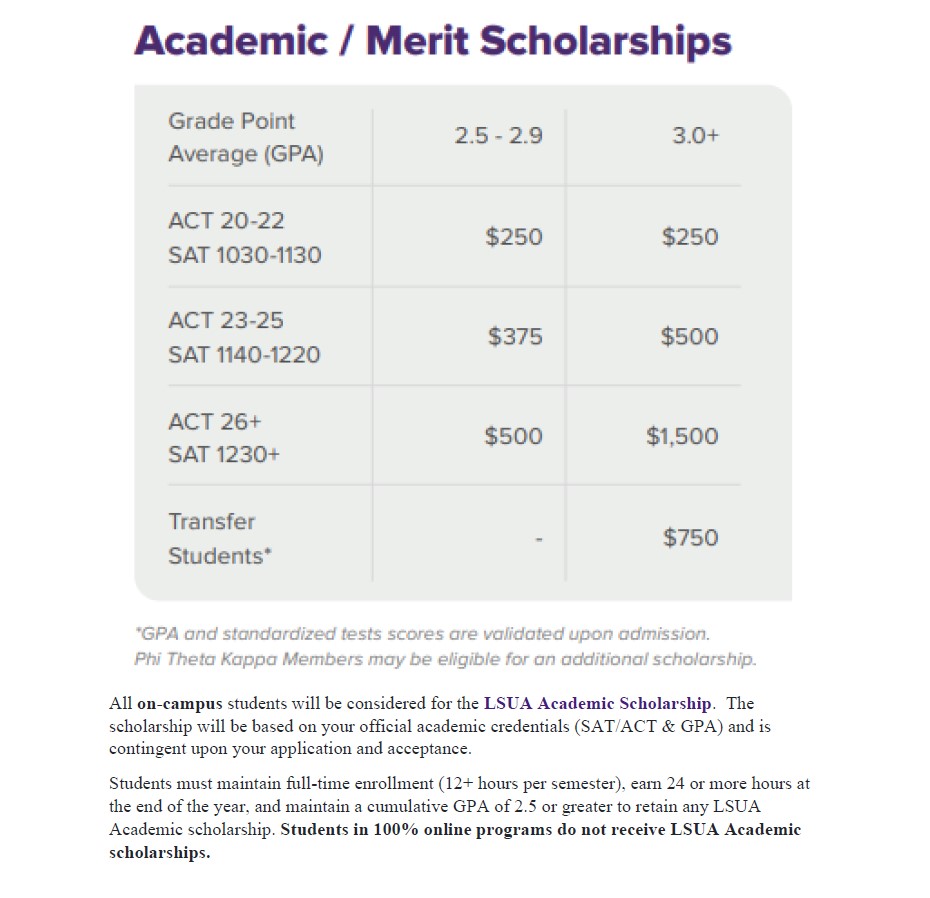

LSUA ACADEMIC SCHOLARSHIPS

LSUA Foundation Scholarships

Many generous donors establish scholarships in support of higher education in Central Louisiana. Three types of scholarships are available: Endowed Scholarships for First Generation Students, General Endowed Scholarships; and Un-endowed scholarships. Each scholarship details the requirements the student must meet in order to be awarded and to retain the scholarship. All scholarships are awarded through LSUA Scholarships. If you are interested in supporting an LSUA Scholarship please contact the LSUA Foundation office at 318-619-2917.

Lettie Pate Whitehead Scholarship

The Lettie Pate scholarship is awarded each semester to applicants who meet all scholarship criteria.

This scholarship is externally funded and therefore there is a limited number awarded each semester. Applications begin being accepted once registration opens for that semester and are awarded on a first come first serve basis. We encourage students to submit there application as soon as they have registered for that semester.

Awarding will begin prior to the anticipated aid period beginning for that semester.

Current eligibility criteria are as follows:

- Be a female

- Be of Christian faith

- Be enrolled at the clinical level in the Associate's Nursing degree program or enrolled in the Bachelor of Nursing program

- Must have a valid FAFSA received by LSUA for the semester in question

- If selected for verification, it must be fully completed

- Must have financial need as determined by the 2024-2025 FAFSA

- Must be a resident of one of the following states: AL, FL, GA, LA, MS, NC, SC, TN, VA

The application is located at https://www.lsua.edu/financial-aid/resources/forms-index. Please be sure to always access the application from here in order to ensure you are submitting the most recent form. Inaccurate forms will not be processed and will not hold your place in the submission line.

External Scholarships (Private)

In addition to scholarships offered through LSUA, students are encouraged to apply for scholarships through various businesses, community organizations, family employers, etc. We strongly encourage students to continuously search and apply for as many external scholarships as they can find.

As with anything done on the internet, please take heed to avoid scholarship scams. You should never have to pay to apply for a scholarship as well as provide information like SSNs, etc.

Check out The College Monks blog on how to avoid scholarship scams: https://www.thecollegemonk.com/scholarship-scams/b/217.

Here are a few trusted links for additional scholarship search engines and scholarship opportunities:

***Important note: LSUA Scholarships are not available for any 100% online degree programs.***

***Important note: There are many scholarship scams out there. Do not ever pay money to apply for a scholarship***

TOPS

Learn what the TOPS award is, how to qualify, who is eligible, and other resources HERE.

Fall & Spring - Full time* = $2447 per semester.

Tops Performance stipend = $200 per semester

Tops Honors Stipend = $400 per semester

Students must be enrolled full time (12 credit hours) as of the 15th class day of each semester in order to receive their award. Students in clinical courses or student teaching are exempted from this rule and may still receive their award at a prorated rate.

- If you enroll for Elearn 2 only after the 15th class day of the semester you will need to notify our office if you are eligible for TOPS.

- 100% online students must also be enrolled in 12 hours to receive TOPS for the semester. How you break this up between the terms is up to you but your hours must total 12 or more between the ELearn 1 and ELearn 2 term through the census day.

TOPS TECH: Students must be enrolled in either the Associate of Science in Radiologic Technology, Associate of Medical Laboratory Science, or the Associate of Science in Nursing programs. Only students in these programs that graduated high school Spring 2017 and beyond are eligible for Tops Tech in the below amounts.

AS Nursing / AS MLS = $1190 per semester

AS Rad Tech = $2447 per semester

TOPS Tech is valid for up to 4 semesters.

TOPS Opportunity, Performance, and Honors are valid for up to 8 semesters.

Grants are a type of financial aid a student receives based income information reported on the FAFSA. The source of a grant may be through the federal government or state government. To apply for all grants a student should complete the FAFSA by LSUA's priority deadline of March 1st prior to the start of a Fall Semester and submit all additionally requested information to the LSUA Financial Aid Office by May 1. Any additional requested information will be listed only in the student's Net Partner Account. Students must also meet Satisfactory Academic Progress standards to be considered eligible for grants.

While there are a number of Grant programs, the Federal Pell Grant is the only guaranteed grant program. Students interested in applying for all grants processed through LSUA's Financial Aid Office must: complete the FAFSA; submit all paperwork requested as listed in the student's Net Partner Account; and maintain Satisfactory Academic Progress.

Grants are a type of "Free Money", meaning they do not typically require repayment. There are schedule changes and resignations that can result in a grant having to be repaid. Due to this we strongly encourage students to check with our office before submitting any schedule changes.

Check Schedule change impacts and Return of Title IV fund information on our RESOURCES page.

The Teacher Education Assistance for College and Higher Education (TEACH) Grant Program provides grant assistance to undergraduate students who:

- agree to serve for at least four years as full-time “highly qualified” teachers in “high need” fields (as defined by the U.S. Department of Education)

- at public or not-for-profit private elementary or secondary schools

- that serve students from low-income families (as defined by the U.S. Department of Education)

Students must meet the following to qualify for TEACH Grant funds:

- Be eligible for Title IV Aid

- Be formally enrolled and actively pursuing coursework in the Professional Teacher Education Program (admitted to blocks) OR be actively pursuing coursework for the Minor in Education for Secondary Certification (admitted to the education program)

- Have a cumulative GPA of 3.25 or higher; or have scored above the 75% percentile on any section of the ACT/SAT (verification required)

- Complete an Initial and Subsequent Counseling session (online) each year.

- Complete an Agreement to Serve (once).

Students interested in receiving TEACH Grant Funds should:

- Obtain the LSUA Teach Grant Application from their Education Advisor, complete advising session and have advisor sign application. The application must be completed each semester.

- Register for classes according to advisor recommendations.

- Print copy of schedule, attach to LSUA TEACH Grant Application and return to Education department.

- Go to https://studentaid.gov/teach-grant-program and complete both the Initial and subsequent counseling (approximately 45 minutes) and the Agreement to Serve (approximately 30 minutes).

LSUA’s financial aid office will receive notification when the counseling and Agreement to Serve have been completed. The education department will forward the LSUA application and the printed schedule to the financial aid office. Funds will be processed like any other aid, and will be included in anticipated aid prior to the semester starting if all information is received in adequate time.

Students are required to complete the application each semester. The application can be found with your Education Academic Advisor or the Education Department.

Amounts are as follows:

- maximum of

-$1886 Full time - maximum of

-$1414 9-11 hours - maximum of

- $943 6-8 hours - maximum of

- $471 1-5 hours

If you are receiving tuition assistance from your employer via letters of credit we will process those as miscellaneous scholarships on your account.

Please have your employer forward the full letter of credit to Scholarships@lsua.edu and AccountingServices@lsua.edu.

It is important we receive all pages of the letter of credit as these contain important stipulations regarding how it is to be applied based on your employers requirements. Some will require any gift aid (scholarships, grants, etc.) be applied prior to the credit. In that case, your award would reflect only any remaining balance after. In the event your gift aid fully covers your course, no award will be applied.

If your letter of credit amount is greater than the charges for that course, only the amount charged will be awarded.

Our Accounting office will send the invoice to your employer after the add/drop period of the term. If your employer requires an invoice prior to that, please notify AccountingServices@lsua.edu.

IMPORTANT: Once invoiced and payment is received, some employers will only pay specific charges and not others. If the payment received is less than the letter of credit and award amount, we will have to reduce your award. This can then create a balance owed back to LSUA and will be the students responsibility to pay.

GUILD is an employer paid tuition assistance program. Learn more at GUILD.com

The LSUA Financial Aid Office will receive a roster from GUILD beginning 2 weeks prior to the start of a term. We will notify both the Accounting office and the student of their eligibility as we receive it.

- If you receive your eligibility notice and are eligible with sufficient funding, there is nothing you need to do in regards to the payment deadline. We will notify Accounting.

- If you are capped or ineligible, other payment arrangements must be made to pay any outstanding charges

- Funding will not be posted until after payment is received from GUILD which will be after the term has ended.

- If you are Pell eligible, GUILD will only pay the balance after Pell, up to your annual limit, so be sure to accept that award.

- If your employer offers book reimbursement, LSUA has no access of that information and this will reduce your annual amount, if capped.

- If your eligibility changes after the “lock” date (second day of class) it is your responsibility to let our office know as we stop running the roster at that time.

- If you lose eligibility (change jobs, GPA) you are responsible for any unpaid balance with LSUA.

- Since GUILD pays so late, if you are using other financial aid (student loans) in order to purchase books, please email the Financial Aid office and let us know. We will have to request the bookstore manager create your account manually.

AMAZON is another employer paid tuition assistance program and is processed similarly to GUILD.

The LSUA Financial Aid Office will receive your payment requests prior to the start of a term. We will notify both the Accounting office and the student of their eligibility as we receive it.

- If you receive your eligibility notice and are eligible with sufficient funding, there is nothing you need to do in regards to the payment deadline. We will notify Accounting.

- Funding will not be posted until after the census day of that term, which is when we will complete your payment requests.

- We can only certify for your exact cost of tuition and fees, even if your available funding exceeds that amount.

The Louisiana National Guard offers a State Tuition Exemption Program (STEP) that is available to its members. It is Louisiana state law that *”Any student enrolled, or who may enroll, in a public institution of higher learning of this state who is seventeen years of age or over and who is serving in the Louisiana National Guard shall be exempt from all or a portion of tuition charges imposed by such institution of higher learning if the applicant for free tuition is presently domiciled in Louisiana.” *Excerpt from § 36.1. Exemptions from tuition charges for service in the Louisiana National Guard, LSA-R.S. 29:36.1

The Louisiana National Guard offers 100% free college tuition to its members. Get your college paid for at no charge to you!

The Louisiana National Guard also provides:

- $439 GI Bill benefit a month, tax-free to full-time students

- Up to $20,000 sign-on bonus

- An additional $350 GI Bill Kicker, tax-free, to qualified applicants

- Affordable healthcare

- A resume booster

- And, serve right here at home!

We only serve one weekend a month and two weeks during the summer.

Contact SSG Sydney Matthew at (318) 955 - 0887 for more information.

Office located above the cafeteria in the Student Center.

LSUA receives limited funds to award students jobs through the Federal Work-Study Program. To qualify for a work-study award, a student must demonstrate financial need as determined by information reported on the FAFSA and other types of financial aid the student may be receiving. Students must also meet Satisfactory Academic Progress.

To apply for a campus job, students need to:

Loans are a resource to assist in paying for the costs of going to college in which a student or parent borrows money that must be repaid. Student loans are a type of financial aid and are subject to many of the same criteria as all other federal aid programs. It is important to remember that student loans must be repaid.

To receive a student loan at LSUA, students must complete the FAFSA, enroll in at least a half-time status of eligible hours (see the Federal Funds Info document for details on eligible courses), and be maintaining Satisfactory Academic Progress. Students cannot exceed their lifetime loan limits of $31,000 for Dependent students and $57,500 for Independent students. Also loans cannot exceed annual limits or annual/semester cost of attendance budgets.

Check Schedule change impacts and Return of Title IV fund information on our RESOURCES page.

Annual limits are as follows:

Freshmen (0-29 earned hours): Dependent = $5,500 Independent $9,500

Sophomore (30-59 earned hours): Dependent = $6,500 Independent = $10,500

*Students in Certificate or Associate programs cannot be awarded above the sophomore level, regardless of the number of earned hours)

Juniors/Seniors (60+ earned hours Bachelor/Post Bach programs only): DEP = $7,500 IND = $12,500

The main loan program that LSUA students participate in is the Federal Direct Loan Program. Direct loans include Stafford Loans borrowed by the student and Parent PLUS loans borrowed by the parent of a dependent student. For additional information regarding the Federal Direct Loan Program, visit studentaid.gov

LSUA FEDERAL LOAN STATISTICS

- LSUA's current cohort default rate is 3.3%

- The National average cohort default rate is 2.3%

- 37% of LSUA students received a Federal loan during the 2022-2023 award year

Steps to Apply for a Federal Direct Student Loan

Before a student may complete the Online Loan Application, LSUA must have received a processed a current FAFSA for the student. LSUA will award the maximum eligible loan amount available to each student. You may complete the below application if you have declined that award, reduced it, or do not yet see it in your Netpartner accept awards tab.

- Access the AddLoanReq_2425

- Complete and hand sign the application

- Email the application to FinancialAid@lsua.edu or drop it off in person

- Complete a Direct Loan Entrance Counseling Session online

- Complete a Direct Loan Master Promissory Note online

Dependent Students:

If you are at your annual Federal loan limit and still are needing additional financial assistance, your parent can request a parent PLUS loan. These are credit based Federal loans that are repaid by the parent who was approved. If the credit decision is denied, LSUA can then award you up to the Independent student annual limit.

To apply for a Parent PLUS loan:

- Your parent must log in to studentaid.gov using THEIR FSA ID and password

- Loans and Grants

- PLUS Loans: GRAD and PARENT

- Start the "I am a Parent of a Student" application

LSUA will receive the application and decision the next business day.

All loans are subject to an origination fee prior to disbursement that is removed from the gross amount. Below are the Interest rates and origination fees for the past and current year.

Origination Fee

Award | Fee removed from each disbursement amount: |

|---|---|

Direct Subsidized | 1.057% |

Direct Unsubsidized | 1.057% |

Direct PLUS (parent) | 4.228% |

Interest Rates

Award | 2023-2024 First disbursed on or after 07/01/2023 and before 07/01/2024 | 2024-2025 First disbursed on or after 07/01/2024 and before 07/01/2025 |

|---|---|---|

Direct Subsidized | 5.50% | 6.53% |

Direct Unsubsidized | 5.50% | 6.53% |

Direct PLUS (parent) | 8.05% | 9.08% |

It is strongly recommended that students exhaust all Federal student loan eligibility before applying for private student loans. If you are not eligible for any reason to receive Federal Stafford or PLUS loans, you may wish to apply for a private student loan through an outside lender. Many lending institutions offer student loans, and while the eligibility criteria differ for each financial institution, all are credit-based. There is no limit to the amount you may be approved for, unlike the Federal loans, except your award cannot exceed your cost of attendance budget minus other aid.

LSU of Alexandria does not prefer, recommend, promote, endorse, or suggest any lender over the other. You are not required to borrow from any of the lenders on the list and there is no penalty for selecting a different lender, if you prefer. For a list of private student loan lenders, please click HERE.